The federal salary cap is the maximum compensation that federal employees can earn based on the General Schedule (GS) payscale. It changes depending on the locality area and increases each fiscal year.

Discover the pay cap for federal employees, including pay scales and locality rate adjustments for the fiscal year 2024.

Table of Contents

What is the Federal Salary Cap?

The federal salary cap is the ceiling that government employees can receive each year. It is determined by statutory regulations, budgetary programs, and government policies. It also depends on factors such as:

- Executive Schedule

- Base pay

- Locality pay

- Special salary rates.

Salary Cap for Federal Employees

The federal employee pay cap differs from year to year. In fiscal year 2024, the wage ceiling, inclusive of basic pay and locality pay, for most federal personnel is set at $191,900. Conversely, federal pay in 2023 peaked at $183,500.

Here’s an overview of GS employees’ salary cap from 2020 to 2024:

GS Federal Pay Scale For 2024

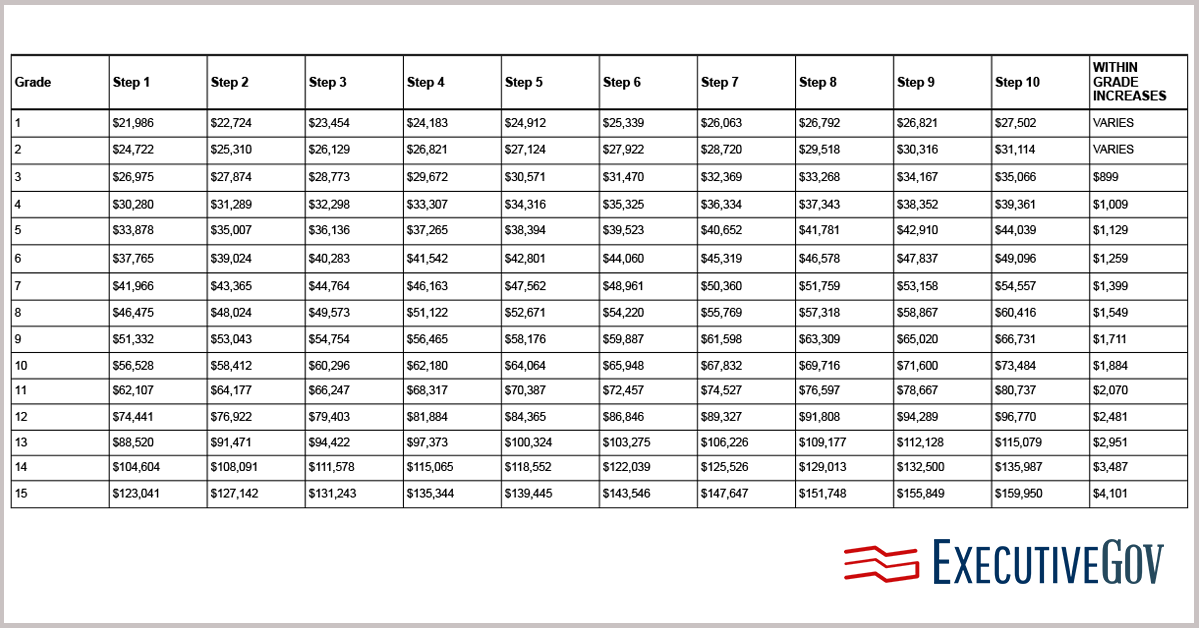

The General Schedule (GS) is the primary pay framework of the federal workforce. It consists of 15 grades, each with 10 steps to determine the base pay for different positions. The base pay is then adjusted according to the locality adjustment rate set by the OPM (Office of Personnel Management) pay locality.

Federal employees receive periodic increases or within-grade increases (WGI) when they transition from one step to the next within their assigned grade. WGIs depend on the performance and tenure of the employee in their current step.

Specific waiting periods also apply.

- 1 year for Steps 1-3

- 2 years for Steps 4-6

- 3 years for Steps 7-9.

Below is the GS pay scale in 2024, which took effect on January 1, 2024.

GS Locality Rate Adjustments in 2024

On top of the base pay, government employees may receive a locality pay adjustment. These adjustments vary based on the cost of living in specific local areas.

For example, as outlined in the Executive Order issued in December 2023, GS employees are set to receive a 4.7% increase in base pay, accompanied by a 0.5% hike in locality pay. This results in an average pay raise of 5.2% in fiscal year 2024.

Certain locality areas have high costs of living because of strong economic growth. As a result, federal employees working in these regions receive higher locality pay adjustments to match the living expenses.

Notably, the top five locality areas with the highest percentage pay raise include:

- Seattle-Tacoma, WA (5.7%)

- San Jose-San Francisco-Oakland, CA (5.62%)

- New York-Newark, NY-NJ-CT-PA (5.53%)

- Rochester-Batavia-Seneca Falls, NY (5.46%)

- Los Angeles-Long Beach, CA (5.44%)

In contrast, government employees in areas with more affordable cost of living receive lower pay adjustments. Among the bottom five locality areas with the lowest percentage pay raise are:

- Philadelphia-Reading-Camden, PA-NJ-DE-MD (5.28%)

- Corpus Christi-Kingsville-Alice, TX (4.97%)

- Palm Bay-Melbourne-Titusville, FL (4.97%)

- Miami-Port St. Lucie-Fort Lauderdale, FL (4.94%)

- Houston-The Woodlands, TX (4.89%)

Below is the comprehensive list of GS locality areas, their respective adjustment rates, and the highest pay increase for each area.