A Department of Defense study has found that amid a financially healthy defense industry, small businesses face challenges when it comes to securing cash flow to cover operating expenses and do not enjoy the same opportunities that their large counterparts have when it comes to obtaining working capital.

Failure to obtain functional capital to conduct contract activities may force small businesses to turn to debt and use personal assets, according to the Defense Contract Finance Study.

DOD said Monday the study also looked at financing and payment policy impacts to defense subcontractors and accounting system and related government requirements over a two-decade timeframe.

The study offered seven major recommendations, such as recognizing the role of profit and cash flow in a healthy defense industrial base, improving means to ensure timely payments to subcontractors, assisting small businesses on defense contracts with financing and determining the effectiveness of performance-based payments.

The report consists of major analyses from a federally funded research and development center and three universities, as well as two DOD studies and feedback from small and large companies and trade associations.

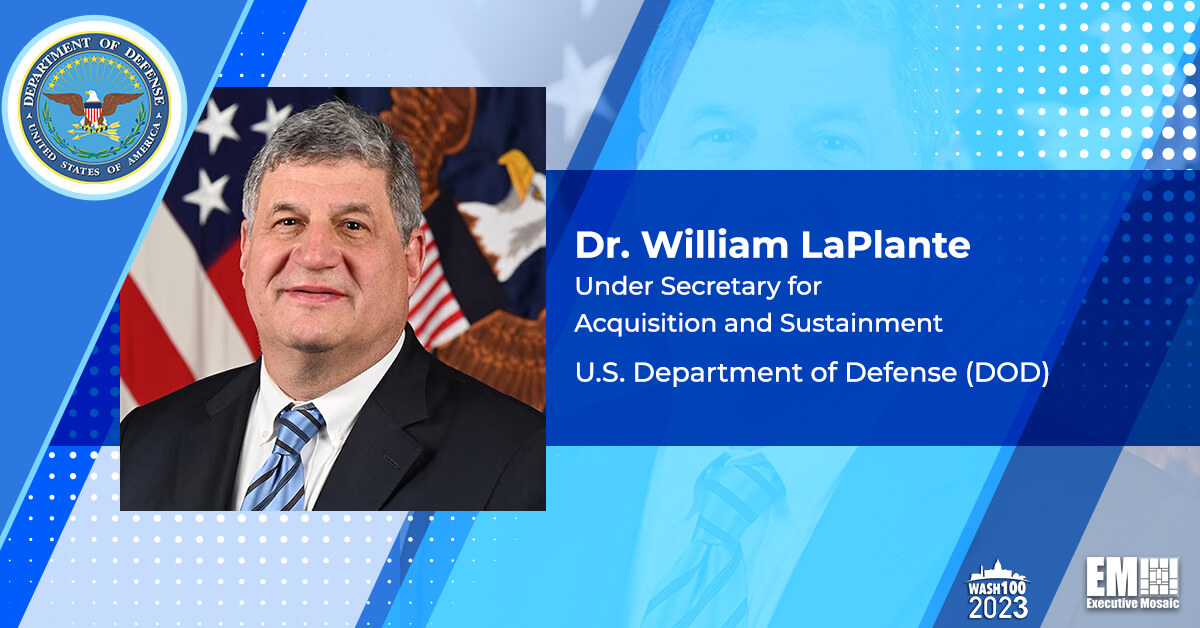

“A financially healthy and robust industrial base is foundational to our ability to deliver the capabilities our warfighters need at speed and scale,” said William LaPlante, under secretary of defense for acquisition and sustainment.

“As the first time the Department has comprehensively assessed contract financing in over 35 years, I look forward to acting upon the study’s recommendations to attract new entrants to the defense marketplace at all levels of the supply chain while maintaining the financial health of our existing partners,” added LaPlante, a 2023 Wash100 awardee.